What exactly is "Subject TO?"

What exactly is "Subject TO?"

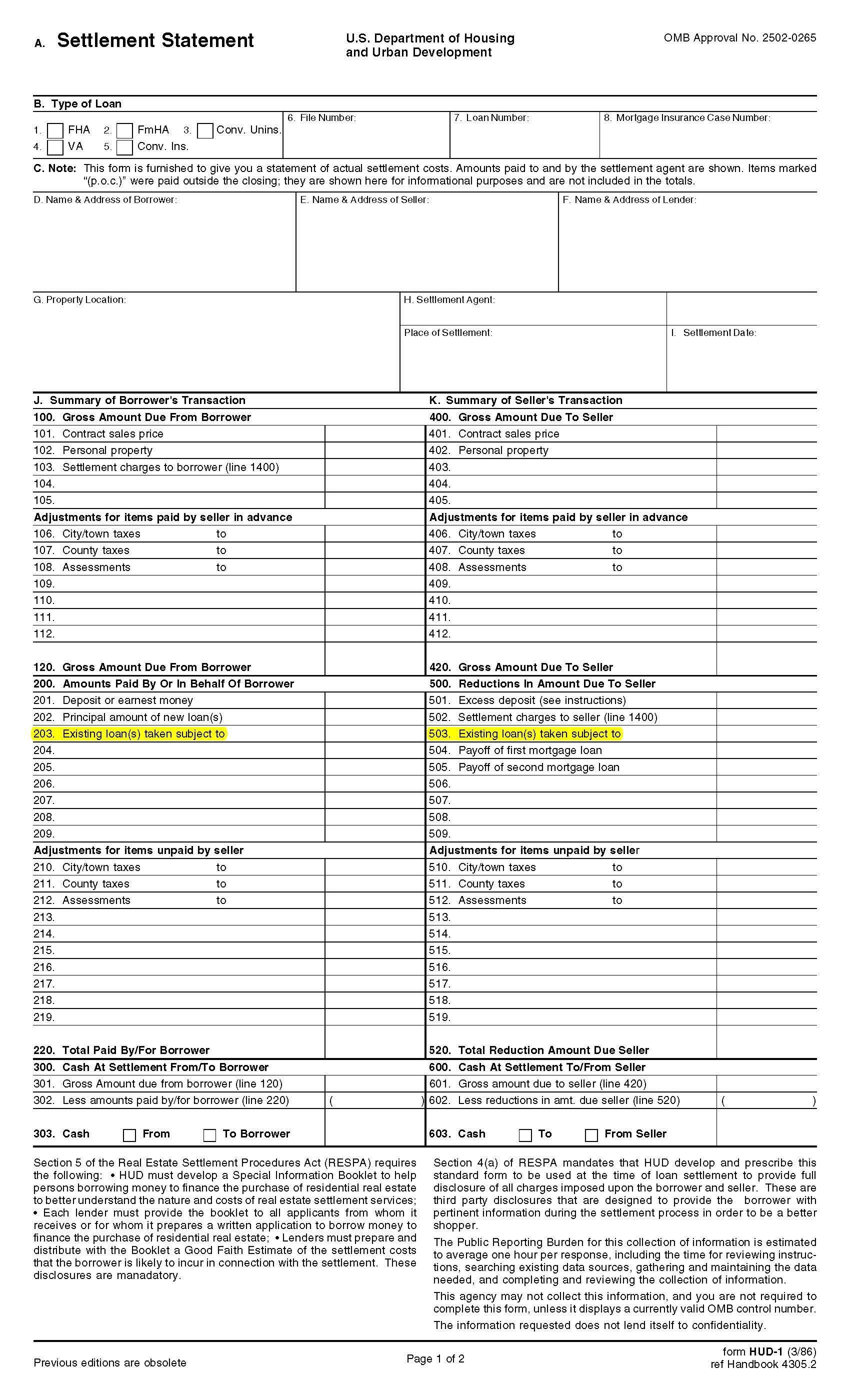

A subject-to transaction or deal is where a homeowner gives you their property, but unlike what some would call a "traditional" real estate scenario, the property is not free of liens or a lien or a mortgage. Instead, it's still "subject to" the existing lien or mortgage, in this case the mortgage that remains.

A "subject to" transaction or deal is basically but not exactly the same thing as the old "assumable" loans , (remember those?) with the difference being that with assumable loans, the bank has given its blessing to the transaction and the liability for the loan will eventually pass to the new owner.

A subject-to transaction or deal on the other hand, is typically done without the specific approval from the lender or mortgage company because it is a private transaction and agreement between the former owner and the new owner or investor. The liability for the loan remains with the previous owner until the loan is paid off with or without a specific time frame.

The traditional or common way that property is purchased when their is an existing mortgage is the following:

let's say the typical person who went out and bought a property the traditional way located at 123 Scottsdale Rd, and they get a mortgage loan from a lender or bank, then two things have taken place:

1. The old owner of the property deeded the property to them, so they are now the owner of the property.

2. Since they didn't have the money to pay cash for the property, they borrowed the money from a lender or bank. But of course the lender or bank wanted some collateral, so they gave them a mortgage against the property to secure the debt. When the closing of this deal is complete, they are still the owner of the property, and the lender or bank owns a mortgage against the property in their name.

Ok now that's the traditional or common way to acquire real estate.

Now let's say something happens in a homeowner or sellers life - maybe a job transfer that they've got to react to very quickly, perhaps loss of income, divorce, or any number of things that change their ability or willingness to pay the mortgage and maintain a house.

Enter you, a smart real estate investor approaching the seller to purchase their home. You explain to them that they the homeowner have the ability to just deed their house to you, (there is a proper way to do this) and that you'll take over the payments on their mortgage.

You could explain to them that it's a lot like a lease, because you'll be paying a mortgage that's in their name. But it's different from a lease because you the investor will be the owner of the property, and therefore required to maintain the property (taxes, insurance, maintenance, repairs).

When the transaction is complete, you'll hold the deed to the property in your name or entity, but your deed is still "subject to" the loan the seller got from the lender or bank because the loan wasn't completely paid off at closing.

In this transaction (Subject To) no credit was required from you the investor and you have a loan or mortgage that came with the deed.

"Subject to" transactions or deals are an incredible way to buy property, and these types of transactions truly require none of your own credit. Creative Real Estate.

So the simple fact is that if having ABSOLUTE, UNDENIABLE ownership of a property is your goal, real estate investing via "subject to" is one of the best ways in creative real estate to achieve that goal.

Subject To is a type of seller or owner financing and it is the strongest type of ownership when it comes to “Seller financing”. What I mean by that is you have the deed, that is why "sub2" or "subject to existing financing" means "get the deed".

"Seller financing" means "any way a home seller can assist a buyer or a tenant to buy their home". Anytime you can get the seller to help fund the purchase of a property it is usually a good thing because unlike most banks the seller can be more flexible with terms.

Subject To deals have always been one of our favorite techniques when acquiring properties. If a seller let's you takeover his payments all you have to do is negotiate any remaining equity (if any) the seller has. A win-win for both seller and buyer.

Most of the times if a seller is upside down they usually aren't concerned about pulling any cash out. You can takeover the existing payment and whatever equity is leftover is yours. We always ask the seller if he is willing to walk away from the property for what is left owed on it and almost all who are looking to walk away from a house and mortgage will.

Who would do that you say? Sellers who may economically default (involuntary foreclosure) and sellers who seek to strategically default (voluntary foreclosure aka walkaways). Both huge markets now.