Get in touch

555-555-5555

mymail@mailservice.com

How to Find, Market and Sell To Buyers and Tenant Buyers Fast

How to Find, Market And Sell To Buyers And Tenant Buyers Fast!

PART ONE:

If your intention as an investor is to keep every house you buy “Subject To” for at least a year or two, or maybe longer that’s ok because if done properly you will have made money on the front (option money), in the middle (monthly profit above mortgage cost) and the back end (sale through cash or financing with your buyer). But that should not deter you from offering it for resale as soon as you get the property.

By offering to sell instead of to rent, you attract a "buyer" mentality. I buy properties creatively (Sub2) so that I can turn right around and offer them FOR SALE with these marketing advantages:

• No money needed (bank qualify)

• Rent-to-own or Lease with Option to Buy

Classified ad #1

NO MONEY NEEDED: Owner can finance down payment

and pay all closing costs. Nice 3 bed, 2 bath, 2 car home, views, privacy, $159,500. 24 hour recorded message 1-928-482-2256

Here we are looking for a buyer to qualify for an 80% to 97% first mortgage. Our ability to carry back a 3% to 20% second mortgage depends on how much equity we have.

I can't see buying houses for more than 80% of what I plan to sell it for with creative terms. There are tons of sellers willing to take 10% below market when you show them what they'll might net "at some uncertain date" going through an agent. Then, getting a 10% premium from my buyer is very common since I'm making it easy to buy.

Will it appraise? Yes. What if it doesn't? Lower your price...or find another buyer...or keep it. Appraisals occur when someone is getting a new bank loan. In most cases, you’ll sell via methods #2 & #3 requiring no new loan until later.

Offering to pay the closing costs (assuming you have enough equity and profit left over to do this) will help buyers with good credit and income, yet no savings. This approach will cost 2%-3% of the purchase price... but it gets your underlying loan (hard money or loan taken subject to) paid off fast.

NOTE: Be cautious about anyone taking your property off the market with contingencies. I don’t do it if I can help it. A realtor representing your buyer may try and will do this. This can be waste of your time and money and you might have to end up putting the house back on the market if the buyers financing falls through. So if my buyer wants to get a new loan, we setup the purchase agreement as a Lease with Option to Buy (with at least 3% non-refundable option deposit) in case their loan is delayed or falls through they can still move in to the house until able to finance and you now have a certain move-in and monthly payment start date.

Yes, my intent is to keep each house I buy for awhile, but if I have a qualified buyer immediately willing to pay my asking price, and I'm getting some or all my cash at closing, I'll take it.

Using Bandit Signs:

Own A Home Today

No Credit Check or Qualify

$5000 Down

Call 928-482-2256

Classified ad #2

Lease With Option To Buy: Nice 3 bed, 2 bath, 2 car home, views, privacy. Pets OK. Rent credit. $159,500. 24 hour

recorded message 1-928-482-2256

This ad is run in the HOMES FOR SALE section.

I can still offer "owner financing" via Lease With Option To Buy if they only have 3-5% down, thereby KEEPING the house as I intended. They will have 12 months to close, and perhaps a right to extend another 12 months in exchange for higher rent (10% annual increase), higher price (1/2% a month after 12 months) and more non- refundable money down.

A tenant buyer is 500% better than a tenant. They take care of the house. They don't call me. There's a non-refundable option deposit. They pay on time or lose their monthly rent credit, and rent discount. They fix up the property and enjoy the feeling of ownership, because they're planning to buy.

But I do risk having them buy the house. My experience is only one out of 3 will close. You can improve those odds by being pickier than I am. Therefore, the average house may resell in 2-3 years after 2-3 tenant buyers (thus meeting my holding period goals).

Does the tenant buyer lose out when they don't buy? Not really. I've never kicked out a tenant buyer if they wanted more time. We just renegotiate the terms. When they do leave it's because of a break up, or job change, transfer, or something like that. They may be better off waking away from a 3-5% purchase deposit after just 1 to 2 years than if they bought the house. Compare it to the normal 2-3% in closing costs to buy with a new loan, and then another 6-9% in costs to resell it though an agent.

BOTTOM LINE: People want to buy, not rent. Offer flexible, creative terms you can put in your classified ads, flyers, signs, etc. Offering to sell to your tenants reduces your management headaches. Collecting several purchase deposits on houses you bought "no money down" can become a reliable INCOME stream. For every 12 houses you buy, you may wind up selling 4, but you'll still have a net gain of 9 properties. Over time you can build a large portfolio. Taking a "quick turn" marketing approach as described above will also help you CASH in big chucks of equity to pay your expenses, and write yourself some "5-FIGURE PAYCHECKS."

So I'll sell the property if someone waives a big wad of cash in my face, but just don't count on it. Typically I will take the first tenant buyer who meets my minimum requirements...

PART TWO:

In part one we discussed advertising strategies for attracting buyers and tenant buyers. Here are 3 more ideas for quickly getting buyers into your homes.

#1: NO MONEY NEEDED or NO MONEY DOWN with Down Payment Grant...

Here is some information on a few programs called Home Plus and Pathway To Purchase organizations providing down payment grants for buyers. This is a strategy for making your ads, flyers and signs compelling AND getting cashed out.

Here's an example of how you can use this program. If you have a buyer who qualifies to borrow 95% to 97%, but does not have any money, you can:

• Pay their closing costs, and

• Get them a grant for their down payment.

The grant is an expense to you, the seller. If the grant is for 3% of the purchase price, then 4% (3% plus 1% fee) will be withheld from your proceeds at closing. If the grant is for 5%, then the cost to you is 6%.

Another example. Buyer is approved for 90% first, 5% owner carry second, and lender requires 5% down. You can use these programs for the 5%, again costing you 6%. I just got around to looking up their web site and I'm now looking to use this program on the next few deals that qualify to see how well it works. For details go to www.pathwaytopurchase.com and www.HomeplusAz.com

#2: ADS TO DRIVE TONS OF CALLS AND BUILD A BUYER'S LIST AHEAD OF TIME...

With a good buyer's list, you can occupy a new property without running a new ad every time you get a home.

NO BANK QUALIFYING: Owner must sell. Two homes available. Call Eric, 1-928-482-2256

You can have a similar long running classified ad appearing in EACH issue or once a month in your local daily and weekly newspapers...

OWNER FINANCING or Lease/Option. 3 nice mountain homes to choose from. 24 hour recorded list

1-928-482-2256

I may have 1 house or I may have 7 but I keep running the same ad without changing it. I just update the recorded list.

#3: SEND POSTCARDS TO THE SURROUNDING NEIGHBORHOOD...

Maintaining a good relationship with your title company will get you the possibility of getting mailing labels and addresses of homeowners near the houses you now own for sale. You can select subdivisions or zip codes to target the area. In many areas, you can get these names on labels through your local tax assessor.

You can add this technique to your arsenal of marketing tools to sell houses fast.

The cost will be about $.25-38 cents per mailed postcard. Printing and mailing 500 cards is only about $125-135. Unconverted prospects can go on your buyer's list. Here is an example of the post card content (a personal message, description of the property, no photo needed):

Buy this home with little or no money down!

This 3 bedroom, 2 bathroom modular home has great views to the south west. There's extra space for parking a boat, RV , also has 2 car garage. It has 1,800 square feet, newer carpet, new kitchen floor. Affordable living in a nice location. Vacant, call to see inside.

Very flexible owner financing or Lease/Option terms.

1234 West Main St Phoenix, Arizona ..........$119,500

Free 24 hour recorded info, call 1-877-384-9505

Dear Neighbor,

Thought you'd appreciate knowing about the home for sale near you at 3335 Elfin Drive. It just became available and I was wondering if you had any family members or friends who might be interested. We own the home and can offer flexible no bank-qualifying owner financing. We can even help finance the down payment!

If you, your immediate family, or your referral purchases this home, we might be able to pay some or all of the closing costs. Be sure to mention this postcard.

Do you know a nice family who might be interested? Please call Sabio or myself at 1-928-482-2256 I'm also writing to all your neighbors... so call right away while this home is still available.

Sincerely,

Eric Brown

Property Manager

Cash Management Properties.

If you print two sides, here is an example of side two:

Cash Management Properties 1933 West Main Street Mesa, Arizona 85201

Call our 24 hour Real Estate Hotline

at 1-928-482-2256, then leave name, number if interested in

current list of homes for sale by owner with flexible owner financing, or to learn more about how our owner financing programs work

RECAP of Part Two:

• Check out Down payment Grant Programs so you can offer

NO MONEY DOWN or NO MONEY NEEDED in your marketing.

• Build a buyer's list with generic ads.

• Hit the surrounding neighborhood with hundreds of postcards and put out your Bandit Signs. NOTE:

You can upload a mailing list and artwork (formatted message) to the postcard

mailing service offered through the United States Post Office at www.usps.com.

Addendum

I’ve added some information on the Section 8 program for those who want to rent or just can’t get a tenant/buyer.

Information on the Section 8 program

Although the Section 8 program can be very rewarding, it can also be very demanding of your time and resources. Toilets never break in the middle of a lazy afternoon when you are looking for something to do. In addition, the Section 8 program provides assistance to low and moderate income families who will live in low to moderate income neighborhoods that may or may not be desirable. So, my first advice is to ask yourself, "Am I ready, willing, and able to be a landlord under these conditions?" If you elect to proceed, here are my thoughts on the Section 8 program:

I believe that the Section 8 program is one of the most useful and underrated tools for investors specializing in low to moderate income rental housing. I know many would vehemently disagree, and their objections usually fall into three categories:

1. The Section 8 program requires additional paperwork. It is true that the program is funded by HUD and administered through a local or state housing development office. Like every other government program, the rules can appear complex. You must use a HUD lease or use a HUD addendum with your lease. The HUD lease is straightforward and reasonably balanced, but I used the HUD addendum so that I could add some "house rules" not included in their document. You will be required to sign a contract with the local Section 8 staff. Like any other contract, if you do not understand it, you can have your attorney review it with you. I found it no more difficult to understand than my first P&SA. You tenants must re-certify with the program every year. There is no getting around this, and it is extra work to track it. If the tenants do not re-certify, you do not get paid. The issue is complicated by the fact that it is the tenant that must obtain the necessary certification. You should use some sort of system alerting you when the anniversary of the tenant's certification was approaching, and begin contacting them approximately 60 days out. If they did not complete the process on time they would not be eligible for any Section 8 assistance and would be forced to move out. In most cases tenants do not fail to re-certify.

1. The second major objection for some investors is that the tenants using Section 8 are so-called undesirable. The single largest group of Section 8 voucher holders in most areas are single mothers, and there are certainly challenges to managing rental properties in lower income areas. But I feel these challenges have more to do with the environment than with the Section 8 program. You are not prevented from screening your tenants with this program. As long as you comply with Fair Housing Law, you can apply whatever screening standards you desire; you are not required to accept a tenant simply because they have a Section 8 voucher. In addition, you may evict tenants under the terms of the lease in accordance with your state and local laws.

2. Then there is the infamous HUD inspection. I do not mean to criticize others, but I hope I would never rent a unit that could not pass a HUD inspection. The checklist is quite long, but it essentially requires every home to have a working stove, refrigerator, hot water heater, and permanent heat source. Most rooms must have either an overhead light and one outlet, or two outlets. Bathrooms must have a toilet, sink, and tub or shower stall; kitchens must have a sink; both must have hot and cold running water. Stairs must be safe, there can be no peeling paint, the roof must not leak, and the walls cannot allow in water or wind. Windows and doors must be unbroken, functional, and equipped with working locks. The only area that might cause concern in older homes is the requirement for all bedrooms to have an exterior window and bathrooms to have either a vent or window. I am sure that there are HUD inspectors that are royal pains in the neck.

In exchange for the extra administrative requirements, as a Section 8 landlord you receive the following advantages:

1. You receive all of the tax advantages of any other buy and hold investor.

2. Cash flow can be significant if you buy right. HUD sets the maximum allowable rent for each county (called Fair Market Rent), but in my area they were always in line with market rents for the neighborhood.

3. Rents are paid by HUD, on time, and the checks never bounce. Any experienced landlord can tell you horror stories about collecting rents, and collections tend to be more of a problem in lower income rentals.

4. If the tenant damages the unit or leaves without notice, you may file a claim with the local Section 8 staff for vacancy loss and/or damages. The payment will only partially reimburse you, but how much do you get from a non- Section 8 tenant? And you can still file suit against the tenant for damages or breach of contract in many cases.

5. In most cities there is a long waiting list for Section 8 housing. This means an almost endless stream of potential residents. Most local housing offices maintain a list of eligible properties, and this is the first place a new voucher recipient looks for a home. Depending on what type of home it is and where, Section 8 eligible units usually never sit vacant for longer than it takes to clean and repaint them.

I believe the advantages of renting to Section 8 tenants (other than collecting

$3000 to $5000 on a lease/option up front) far outweigh any real or imagined disadvantages. Lower income rental properties present significant management challenges and large profit opportunities. The Section 8 program can be an effective tool for the investor specializing in this niche. In exchange for a few extra hours of paperwork a year, you get guaranteed rents, a large pool of potential tenants, and some protection from unexpected damages and vacancy.

Eric

New Paragraph

"Subject To" Real Estate Investors

Stay up-to-date with Subject To Real Estate Investors news

Subscribe to our newsletter

We will get back to you as soon as possible.

Please try again later.

The Advanced Real Estate Investing Academy, Subject To Real Estate Investors, Subject To Real Estate Academy, Creative Real Estate Investors, Eric Brown and Constance Salas are not a law firm and do not provide legal advice. Your use of The Advanced Real Estate Investing Academy, Subject To Real Estate Investors, Eric Brown and Constance Salas materials, forms, or services ("materials") does not create an attorney-client relationship between you and The Advanced Real Estate Investing Academy, Subject To Real Estate Investors, Eric Brown and Constance Salas. You agree that all decisions you make on legal matters are your full responsibility and you agree to retain legal counsel licensed to practice in your jurisdiction to review any materials you use and the manner in which you intend to use them. Rescheduling the course, sessions and classes may occur due to inclement weather and other factors beyond our control. All sales are final. There are no refunds.

All Rights Reserved | Copyright 2025

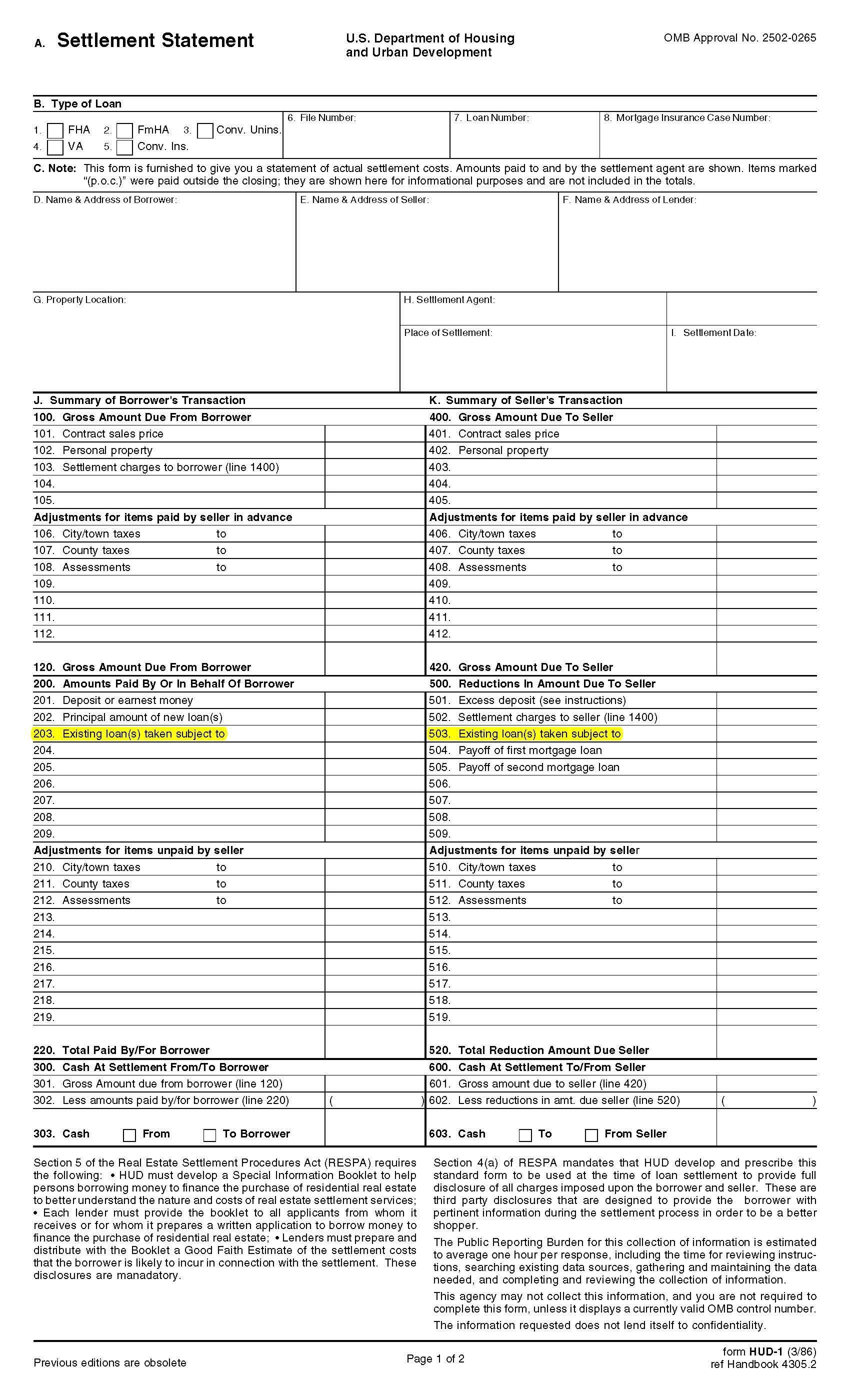

Subject To Real Estate I nvestors